How can you as a start-up can catch the eye of VC firms? In this article we give you 5 insights in the VC selection process to help you become investor ready.

At ttopstart, we support leading researchers and innovative companies in the fields of Life Sciences and Health (LSH), to change patients’ lives for the better. Our consultants help to obtain funding to accelerate the introduction of impactful innovations.

Valley of Deaths

During the innovation development process start-ups face periods of negative cash flow. The lack of funding and support in these stages are called Valley of Deaths. Finances are lacking in the early stages, when the uncertainties and thus risks are high, but also in the later stages when a significant amount of money is needed for validation and scale-up. In general, Venture Capital (VC) firms tolerate more risky investments. This raises the question: “In the highly competitive LSH field with scarce available funding, how can early-stage biotech and medtech startups successfully obtain VC financing?”

6 general criteria

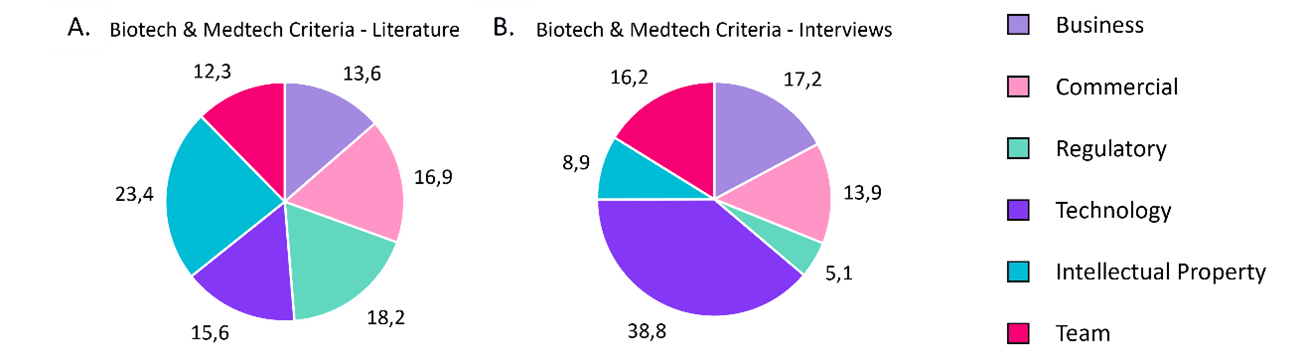

Papers on the investment decision process for venture capitalists in the life science1–5 tried to categorize the factors influencing the choice of VCs. They identified Business, commercial, regulatory, technology, Intellectual Property and Team aspects as the 6 general classes of criteria used by VCs in their selection process. In these papers, no clear prioritization was given to the different criteria (Figure 1A), while we hypothesized that some specific criteria falling within the general categories could be the point of focus in the selection of prospect investments. We validated this by interviewing 9 VC firms and 3 entrepreneurs. Interestingly, the interviews did confirm the use of these 6 classes, however here we were able to distinguish between the importance that was given by the VCs to the different criteria. We provide you 5 key insights on how VC firms select startups for investments.

Insight 1: Investors look for whether the science behind the technology is “rooted in a solid base”.

Technology was clearly the most important aspect of the company seeking investment. The criteria on technology were sometimes defined by the investors as “the science”. It included aspects such as the solidity of the biological hypothesis, the experimental design and the fit between the solution and a real unmet need. When investors assess a proposition for a new technology, they look for whether the science is “rooted in a solid base”.

“Is the story solid or is it really flimsy and based on all sorts of assumptions? Science is embedding the whole proposition and really giving the substance to it” – Venture capitalist specialised in seed investments in both biotech and medtech fields.

Insight 2: IP and regulatory aspects are black-or-white criteria

IP and regulatory aspects are either met or not in a black and white manner. Thus, less importance was given to them by the investors. For instance, early investors are generally willing to take up the risk and support IP creation, while for later stage VCs the IP portfolio should already look good. Similarly, either there is favorable regulation or not, thus the investors have little power on this.

Figure 1. Recurrency (%) of the six general criteria used by VC in the selection process of prospect investments in biotech and medtech. Panels A. and B. show data derived from the analysis of the literature and the interviews, respectively.

Insight 3: Impact and technology-related factors rank the highest in priority according to VCs

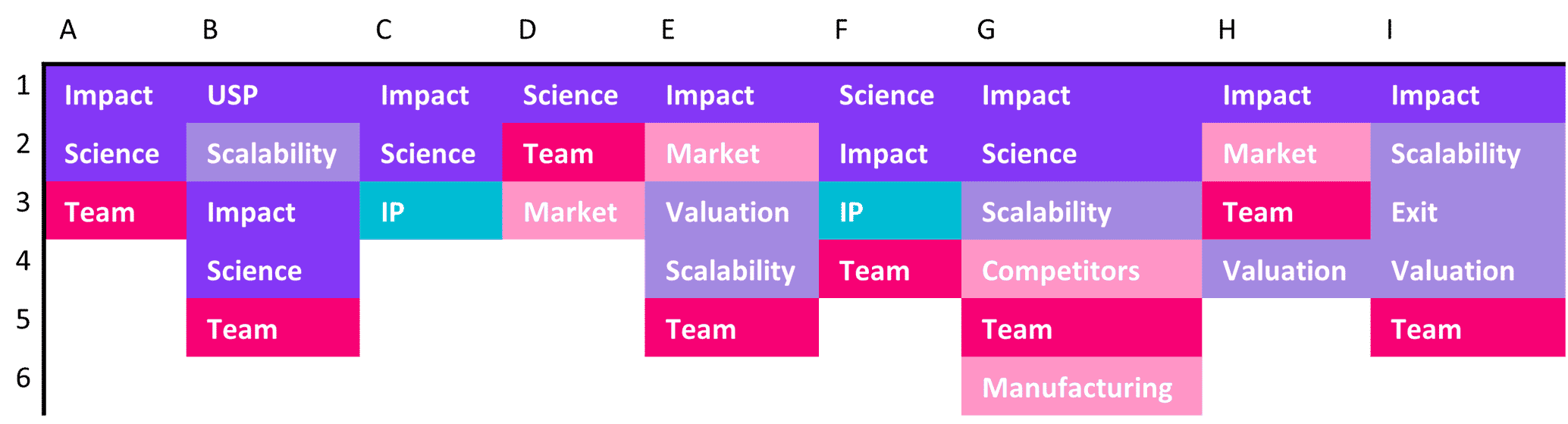

The six classes are however broad, so what exactly do VCs evaluate? We asked the 9 VCs (i.e. A-I) to list and prioritize specific criteria evaluated during the selection process (Table 1).

Table 1. Rankings of the specific criteria in order of priority. The investors (A-I) listed the specific criteria they evaluate during the selection process, and this resulted in the rankings below. The criteria are colour-coded based on the legend used for the general criteria in Figure 1.

All the investors first look at the impact and other technology-related factors (purple ones) and then, depending on the VC firm they start investigating other aspects.

Two elements contribute to the impact of a technology: 1) the problem–solution fit and 2) the healthcare benefits. On the one hand, it is important to answer the question on whether the innovation is tackling a real unmet need. On the other hand, the impact depends on the measurable benefits, often financial, that would derive from applying the innovation. Especially for later stage investors in medical devices, the Health Technology Assessment (HTA) should be carried out soon enough to get a broad picture of the impact on healthcare and more chances of having the technology reimbursed.

“Medtech and digital health have to put together high levels of clinical evidence and health economic benefits studies to prove the benefits of their technology and get reimbursement.” – Venture capitalist specialized in Series A investments in both biotech and medtech fields.

Insight 4: Seed VCs require a proof of concept (PoC)

In most cases even Seed VCs require a proof of concept (PoC) as a de-risking factor for the investment. Especially in biotech where the technological risk is high, obtaining a PoC is a hurdle as there are frequent issues with foreseeing the development of experiments. One of the interviewees, an experienced entrepreneur in both biotech and medtech, highlighted that hurdles are especially related to the translatability from preclinical to clinical studies and the safety of the product. If you are interested in knowing more about what each criterion specifically means, get in touch with ttopstart via the contact form below.

Insight 5: The importance of the team varies largely according to the investors

Different investors have largely varying opinions on the importance of the team. Many VC firms claim that a good team can make successful even ideas that do not seem so successful on paper. Vice versa, when the technology is really promising, certain VC are willing to embark on the journey on the condition that improvements on the team are made. It is therefore key for startups to acknowledge their lacking point within the team and be open to changes or seek additional expertise before applying for funds.

Conclusion

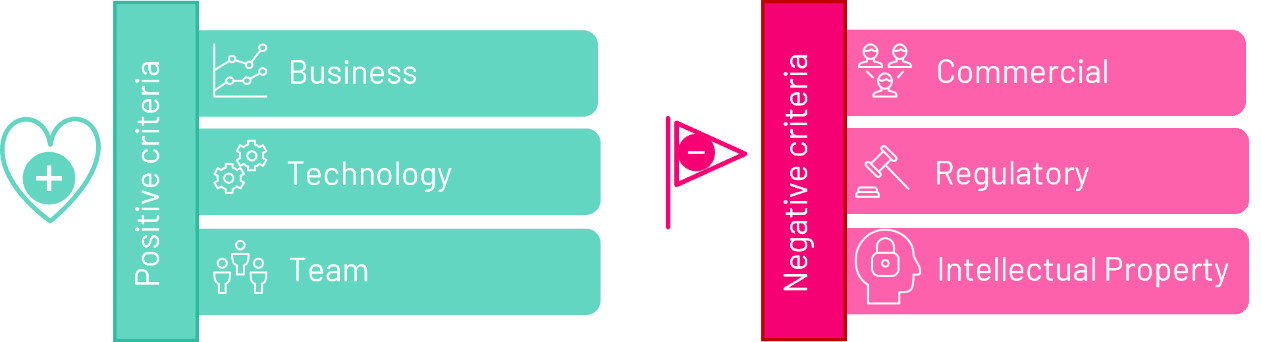

There is no fixed recipe for selecting new investments, but venture capitalists agree on the value that criteria have. Some criteria have a positive effect making startups like you stand out, while others have a negative impact on the selection. One of the interviewees defined them as follows:

“The negative criteria are never going to be the reason why we decide to invest but they will be a reason for why we will not invest into a company. Whereas the positive criteria are what get us excited about a prospect investment” – Venture capitalist specialised in seed investments in the field of biotech

Positive criteria are flexible criteria that are determined by factors internal to the startup (e.g. impact, business model and team composition). Negative criteria are fixed because determined by factors external to the startup (e.g. regulatory framework, IP landscape and competitors).

Figure 2. Positive and negative selection criteria. Class of factors that act as either convincing factor (Positive criteria on the left) or as red flags (Negative criteria on the right) during the selection process. Negative criteria are also often defined as the knock-out criteria.

To stand out, startups like you should be able to:

- define clear milestones to convince the investors of the progressive de-risking of the technology;

- think about the business model. For this, strategic considerations on regulation and reimbursement should be made;

- consider whether in the team there is a balance between technical, entrepreneurial, and managerial experience in the specific field of innovation.

How can we at ttopstart use these insights to support you in getting VC investments?

ttopstart is ready to support you!

Success in biotech or medtech requires a business strategy that can break through the many market hurdles. Our team of consultants can help you with a variety of services, including:

- A company analysis to score all the criteria considered by the investors score and assess your chances at getting VC funding;

- Supporting you in selling your strengths/positive criteria (e.g. business plan/pitch deck/story telling) and overcoming your weaknesses/negative criteria (e.g. market research, link to IP attorney, brainstorm sessions, business modelling).

Are you looking for funding opportunities? Get in touch! For more details on our research results, feel free to reach out to us via the contact form below.

Bibliography

- Fernald, K., Hoeben, R. & Claassen, E. Venture capitalists as gatekeepers for biotechnological innovation. J. Commer. Biotechnol. 21, 32–41 (2015).

- Kolchinsky, P. The Entrepreneur’s Guide to a Biotech Startup. (2001).

- Meyerson, G. & Agge, A. Biotech venture capital: The investment decision process. J. Priv. Equity 11, 85–95 (2008).

- Gompers, P. A., Gornall, W., Kaplan, S. N. & Strebulaev, I. A. How do venture capitalists make decisions? J. financ. econ. 135, 169–190 (2020).

- Moritz, A., Diegel, W., Block, J. & Fisch, C. VC investors’ venture screening: the role of the decision maker’s education and experience. J. Bus. Econ. 92, 27–63 (2022).

“There is no fixed recipe for selecting new investments, but venture capitalists agree on the value that criteria have. Some criteria have a positive effect making startups stand out, while others have a negative impact on the selection.

DELIELENA POLI –

CONSULTANT AT TTOPSTART